In today’s digital age, accepting online payments is no longer a luxury—it’s a necessity for businesses of all sizes. A payment gateway is the backbone of any e-commerce operation, facilitating secure transactions between merchants and customers.

Choosing the right payment gateway is crucial for success in the competitive online marketplace. The ideal solution should offer a perfect balance of security, functionality, and user experience.

This article will explore the key features to look for when selecting a payment gateway, ensuring that your business can process payments smoothly and grow without limitations. We’ll dive into the essentials of secure transaction processing, seamless integration, multiple payment method support, comprehensive reporting, and reliable customer support.

What is a Payment Gateway?

A payment gateway is a service that securely processes online transactions, acting as an intermediary between the merchant, customer, and financial institutions. It encrypts sensitive data and ensures smooth, safe transactions, protecting both the business and its customers.

When a customer makes a purchase on an e-commerce website, the payment gateway springs into action. It captures the payment details, encrypts them, and securely transmits the information to the acquiring bank for processing. The gateway then communicates with the issuing bank to verify the availability of funds and authorize the transaction. Once approved, the payment gateway notifies the merchant, allowing them to complete the order and deliver the goods or services.

By handling these complex processes behind the scenes, payment gateways enable businesses to focus on what they do best—providing exceptional products and services to their customers. With the right payment gateway in place, merchants can rest assured that their transactions are secure, efficient, and reliable.

Secure Transaction Processing

In the digital commerce landscape, safeguarding transactions is an absolute necessity. A payment gateway fortified with advanced security measures like end-to-end encryption and tokenization plays a crucial role in protecting customer data. End-to-end encryption ensures that information is securely transmitted, transforming it into a code that can only be deciphered by authorized parties. Tokenization further enhances security by substituting sensitive card information with unique tokens, reducing the risk of data exposure.

Adhering to industry regulations, such as PCI DSS (Payment Card Industry Data Security Standard), is essential for any reputable payment gateway. These standards mandate stringent security protocols that businesses must follow to protect cardholder data. Compliance with PCI DSS not only strengthens the gateway’s security posture but also demonstrates a commitment to safeguarding customer information, thus fostering trust.

Incorporating robust anti-fraud mechanisms is another critical component of secure transaction processing. Tools like Address Verification Service (AVS) and Card Verification Value (CVV) checks are instrumental in mitigating fraudulent activities. AVS verifies the address provided by the buyer against the one associated with the card, while CVV checks confirm the card’s authenticity during transactions. Coupled with real-time fraud detection algorithms, these tools provide businesses with the capability to effectively identify and thwart fraudulent attempts, ensuring a secure and seamless payment process.

Seamless Integration and Customization

Selecting a payment gateway that seamlessly aligns with your existing systems is crucial for preserving a unified online experience. Opt for solutions that offer versatile integration options, enabling your business to provide a fluid, branded checkout process that enhances the overall user journey. This not only elevates the customer experience but also strengthens your brand’s presence, ensuring a harmonious transition from product exploration to transaction completion.

Tailoring your payment gateway to reflect your brand’s unique identity is a powerful way to stand out in the competitive digital landscape. Look for gateways that offer extensive customization features, allowing you to mold the payment process to align with your customers’ preferences. Whether it involves modifying the interface to mirror your brand’s visual elements or adding specific fields to gather essential customer insights, customization ensures your gateway supports your broader business objectives.

Moreover, the flexibility of integration means your payment gateway can evolve alongside your business. As you diversify your offerings or expand into new territories, the capability to swiftly adjust your payment processor keeps your operations nimble and responsive. This adaptability is vital for sustaining a competitive advantage and delivering the superior service your customers anticipate.

Multiple Payment Method Support

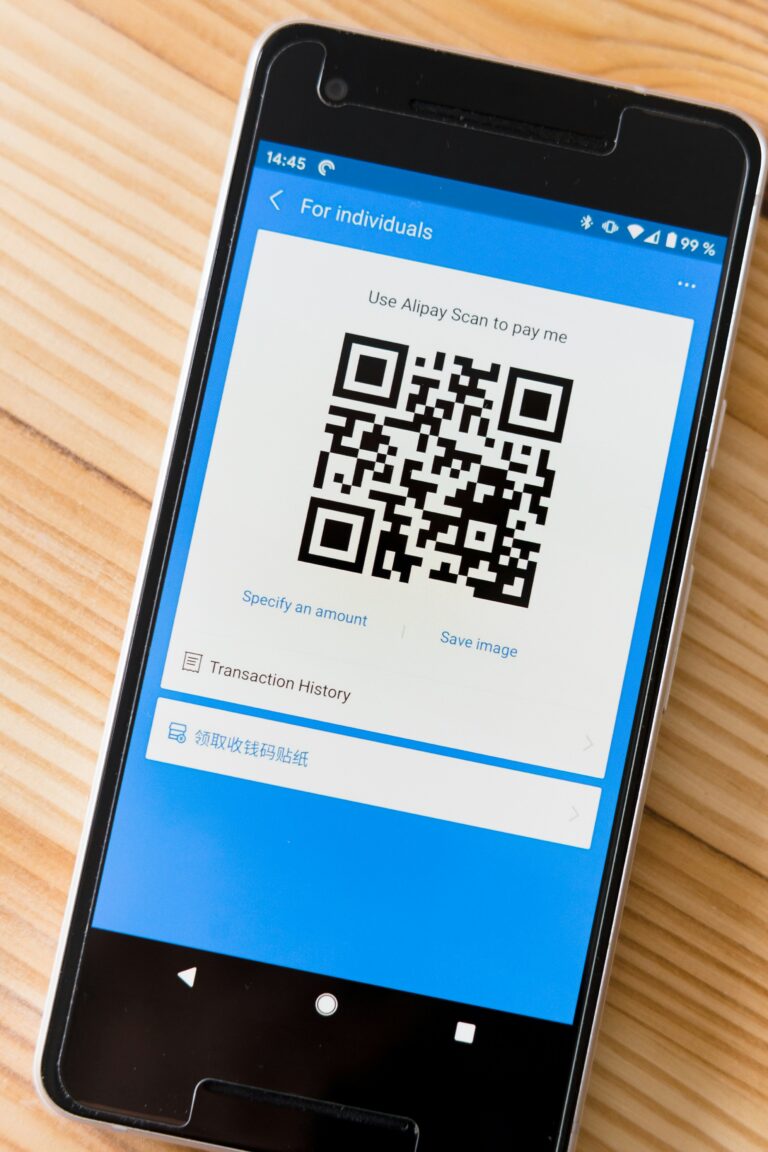

Adapting to the diverse payment preferences of customers worldwide is essential for any business aiming to thrive in today’s interconnected marketplace. A capable payment gateway should seamlessly support a variety of payment methods, including credit and debit cards, digital wallets, and ACH transactions. This adaptability ensures that customers can effortlessly use their preferred payment methods, thereby enhancing satisfaction and fostering loyalty to your brand.

Incorporating multiple currencies into your payment strategy is a strategic move that facilitates global business expansion. As companies extend their reach across borders, the ability to accept payments in different currencies becomes a cornerstone of success. By processing transactions in local currencies, businesses not only simplify the purchasing experience for international customers but also build trust by shielding them from the uncertainties of currency fluctuations. Displaying prices in familiar denominations reduces hesitation and encourages cross-border sales.

Tailoring payment options to accommodate local preferences can significantly enhance conversion rates and customer satisfaction. Consumers are more inclined to finalize purchases when presented with payment methods they recognize and trust. For example, the growing popularity of digital wallets is driven by their convenience and security advantages. By offering widely accepted local payment solutions, businesses can penetrate new markets and address the needs of diverse customer segments. This strategic alignment not only expands a company’s reach but also underscores its commitment to delivering a customer-centric experience, prepared to meet the evolving demands of a global audience.

Comprehensive Reporting and Analytics

Harnessing the power of detailed transaction reporting is key to unlocking valuable insights that drive business success. A comprehensive view of your payment activities allows you to understand customer purchasing patterns, monitor financial health, and refine marketing strategies. By analyzing these patterns, businesses can identify opportunities for upselling, optimize promotional efforts, and enhance overall customer engagement.

Real-time reporting, accessible through customizable dashboards, offers businesses immediate insights into their operations. This capability enables quick identification of trends and anomalies, facilitating timely responses to changing market dynamics. Customizable dashboards provide tailored views of critical metrics, ensuring that decision-makers have direct access to the most pertinent data for strategic planning. This approach allows businesses to maintain agility and make informed decisions that align with their growth objectives.

Advanced analytics tools within a payment gateway extend beyond basic reporting by offering predictive capabilities. These tools enable businesses to forecast demand, optimize inventory, and improve customer experiences through data-driven insights. By identifying trends and potential issues proactively, businesses can implement targeted solutions that enhance efficiency and competitiveness. This strategic use of analytics empowers companies to innovate and thrive in a rapidly evolving market landscape.

Reliable Customer Support

Having access to dependable customer support is a critical component of a successful payment gateway experience. Continuous availability of support ensures that any issues, whether minor or complex, are addressed promptly, safeguarding your business against potential disruptions. This level of support is crucial in maintaining the smooth operation of your payment systems and minimizing any impact on sales.

Support teams with specialized knowledge in payment technologies are essential for effective integration and ongoing system improvements. They not only help troubleshoot immediate concerns but also provide insights that can streamline your payment processes. By leveraging the expertise of such professionals, businesses can enhance their payment workflows and deliver an improved customer experience that contributes to long-term success.

Access to detailed guides and developer resources further empowers businesses to make the most of their payment gateways. These resources offer clear, step-by-step instructions that simplify the integration process and allow businesses to fully utilize their gateway’s capabilities. By equipping businesses with comprehensive resources, payment gateway providers enable them to manage their systems proficiently, reducing reliance on external support and fostering an environment of self-reliance. This strategic support framework allows businesses to focus on delivering exceptional service to their customers.

Choosing the right payment gateway is a critical decision that can significantly impact your business’s success in the digital marketplace. By prioritizing these essential features—secure transaction processing, seamless integration, multiple payment method support, comprehensive reporting, and reliable customer support—you can ensure that your payment system is well-equipped to drive growth and deliver exceptional customer experiences.

Related Frequently Asked Questions

What key security features should I look for in a payment gateway?

Look for end-to-end encryption, tokenization, fraud detection tools, AVS and CVV verification, and full PCI DSS compliance. These features help protect sensitive customer data and reduce the risk of breaches or chargebacks.

Why is integration flexibility important when choosing a gateway?

A flexible payment gateway offers a variety of integration options such as APIs, hosted checkouts, and plugins for popular platforms. This allows businesses to adapt the gateway to their existing tech stack without extensive development time.

How does multi-payment and analytics support benefit businesses?

Supporting a wide range of payment methods (credit cards, digital wallets, ACH, etc.) expands your customer base. Built-in analytics help monitor performance, detect issues early, and optimize checkout and payment strategies.

Devon Clark blends engineering expertise with fintech strategy, bringing 15+ years of experience at the cutting edge of embedded finance. As Director of Embedded Finance & Strategic Partnerships at a leading SaaS firm, Devon has scaled revenue channels, launched GTM partnerships, and simplified complex integrations. He’s passionate about democratizing access to financial tools and regularly contributes insights on emerging trends in B2B fintech infrastructure.