The way customers prefer to pay is rapidly evolving. As a result, merchants are faced with a myriad of payment processing options, each with its own unique features and benefits.

Navigating the complex world of point-of-sale (POS) systems, mobile payments, and online payment solutions can be overwhelming. However, making an informed decision is crucial for businesses looking to streamline operations, enhance customer experiences, and drive growth.

By understanding the key differences between these payment methods and evaluating factors such as transaction volume, integration needs, and customer preferences, merchants can select the right solution that aligns with their business goals. Let’s dive into the world of payment processing and explore how to choose the best system for your business.

Why Choosing the Right POS System Matters

Selecting the right POS system is a critical decision that can significantly impact your business’s success. A well-chosen POS system not only facilitates smooth transactions but also offers a range of benefits that extend far beyond the point of sale.

One of the primary advantages of a robust POS system is its ability to streamline operations. By automating tasks such as inventory management, sales tracking, and customer data collection, a POS system can save valuable time and reduce the risk of human error. This increased efficiency allows business owners and staff to focus on delivering exceptional customer service and driving growth.

Moreover, the right POS system can greatly enhance the customer experience. Features like mobile payments, loyalty programs, and personalized recommendations can create a seamless and engaging shopping experience that keeps customers coming back. In fact, studies have shown that businesses using integrated POS solutions report up to 25% higher customer satisfaction rates compared to those using traditional, fragmented systems.

How to Choose the Right POS System

To find the best POS system for your business, start by examining what makes your business tick. Different businesses have different needs, so pinpoint what yours are. Are you running a busy retail shop, or do you need to take payments on the move? Knowing your operational style will help you find a system that fits seamlessly into your workflows and customer dealings.

When it comes to handling transactions, think about the volume you expect. If your business sees a lot of daily transactions, you’ll need a system that keeps up with the pace without slowing down. Seek out POS solutions that can easily connect with other tools you use, like inventory tracking or customer management systems. This kind of integration helps everything work together smoothly, boosting your efficiency and cutting down on mistakes.

Consider how your customers prefer to pay. People today like having options, from credit cards to mobile and contactless payments. Make sure the POS system you choose can handle these preferences, giving your customers the smooth and flexible checkout experience they expect. By choosing a system that matches changing customer habits, you’re not just meeting current demands—you’re also setting your business up for future success.

Step 1: Evaluate POS System Features

When diving into POS system features, focus on those that can truly boost your business operations. A good POS system doesn’t just handle payments—it becomes the backbone of your daily activities. Start by finding systems that help you keep track of stock and sales. These tools are essential for knowing what’s on your shelves and spotting sales trends, which helps you stock smartly and avoid running out or piling up too much inventory.

Look for systems that can manage customer interactions effectively. Tools that store and analyze customer data can help create personalized offers and reward programs, turning one-time shoppers into regulars. With insights into buying habits, you can tailor marketing efforts to build stronger customer connections.

Also, aim for POS systems that easily link up with other business tools. This means you can connect smoothly with your accounting software or online store, making sure everything runs together without a hitch. This kind of setup helps streamline processes, improve data accuracy, and supports better decision-making.

Step 2: Consider Mobile Payment Solutions

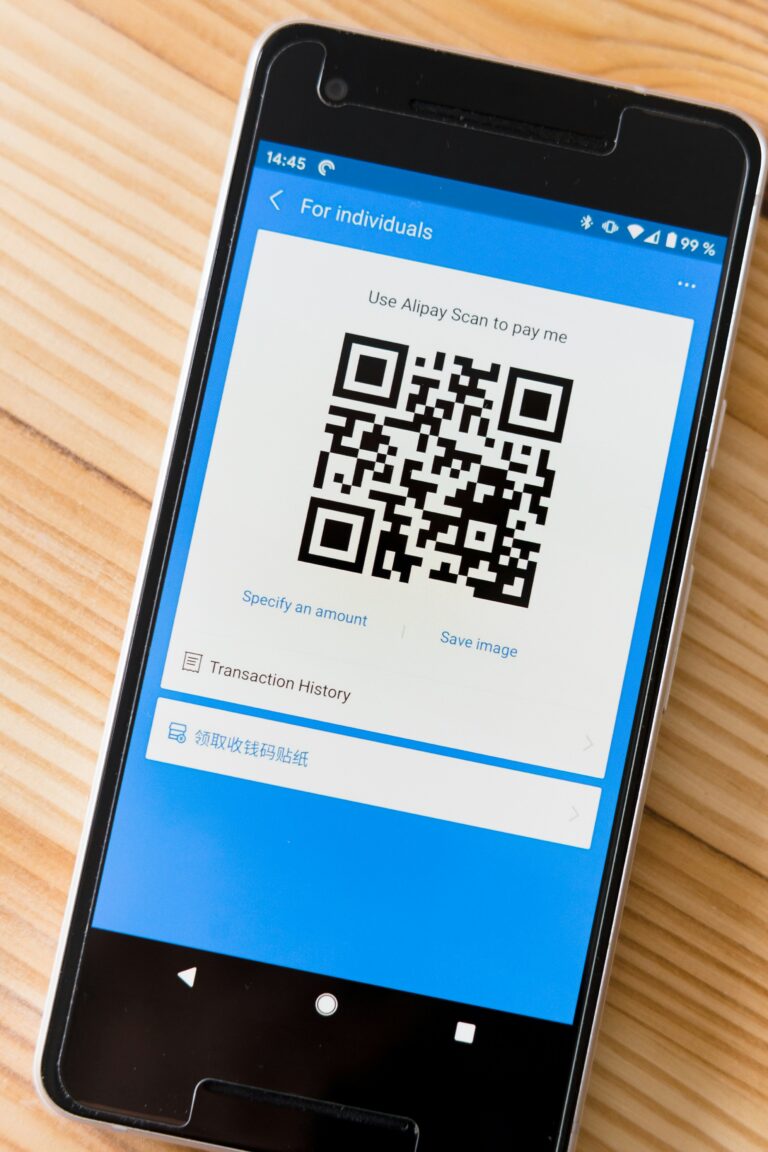

Bringing mobile payment options into your business setup can greatly enhance how customers interact with your services, offering both ease and versatility. As more people rely on their smartphones daily, offering mobile payment methods ensures you’re meeting them where they are most comfortable. This ease of use can lead to quicker checkouts, cutting down on lines and boosting customer satisfaction. Mobile payments simplify the purchasing process, allowing customers to pay with a simple tap or scan, which is especially useful in busy retail settings.

Beyond just convenience, mobile payments add a layer of security for both businesses and customers. These systems use strong encryption to keep payment information safe during transactions, reducing the risk of data breaches. With such security measures, businesses can assure customers that their information is safe, encouraging them to return.

When looking into mobile payment solutions, consider how well they can fit in with what you already use. Seek options that mesh smoothly with your current POS system to boost operational efficiency. By choosing the right mobile payment solutions, you’re not only keeping up with current trends but also positioning your business for future success in an ever-changing digital world.

Step 3: Understand Online Payment Solutions

In today’s digital world, online payment systems are vital for businesses aiming to grow their customer base beyond physical locations. These systems act as a bridge, connecting customers and merchants for easy transactions online. By adopting online payment methods, businesses can reach a wider audience, tapping into markets that were previously out of reach.

Security is crucial when handling online payments. Protecting customer information with strong safety measures helps prevent fraud and builds customer trust. Using secure payment methods ensures that people feel confident when shopping, which encourages them to make purchases and return in the future.

Choosing online payment solutions also involves ensuring they work well with other business systems. Look for systems that easily connect with your online store and other tools you use. This smooth integration helps all parts of your business work well together, making everything run smoothly and keeping customers happy. By picking the right online payment system, businesses can manage transactions efficiently and support long-term growth.

Step 4: Compare Costs of POS Systems

When exploring POS systems, getting a handle on costs is key to smart decisions. Start by looking at what you’ll spend initially—things like equipment and software. While advanced systems might seem pricey at first, they often pay off by making your operations smoother and more efficient over time.

Don’t forget about the ongoing costs. Transaction fees, which come out of each sale, can add up quickly, especially if your business sees a lot of action. It’s important to include these in your budget because they directly impact your profits. There are also monthly fees for things like software updates and support, which keep your system running smoothly and up-to-date.

Balancing these expenses with the benefits they bring helps you understand the financial impact on your business now and in the future. By weighing both the immediate costs and long-term savings, you can find a POS system that fits your financial goals and supports your business growth.

Step 5: Choose a Customizable Payment Platform

Picking a flexible payment platform can make a big difference for your business. It’s important to find a system that can change as your business grows and shifts. This kind of platform lets you add new features or tweak existing ones without needing to start from scratch. This ability to change helps your business stay on top of new trends and respond to what customers want.

Making sure your payment platform works well with the tools you already use is crucial. Look for a system that easily connects with what you have, like your inventory system or customer tools. Having everything work together smoothly saves time and cuts down on mistakes. It helps keep everything running smoothly, so you can focus on serving your customers better.

When you’re looking at platforms, think about ones that offer different ways to adjust them to fit your needs. Whether it’s adding new payment methods or making the checkout process easier for customers, having the option to tailor the platform is a big plus. This flexibility not only meets today’s demands but also gets your business ready for future changes in how people pay.

Final Thoughts

A well-chosen POS system does more than process sales; it becomes a vital part of your business. By making everyday tasks easier and providing valuable insights, it helps you make better choices. This is especially important in today’s fast-moving market where being quick and adaptable gives you an edge.

Choosing a system that fits your business needs and meets customer expectations can lead to smoother operations and happier customers. Such a system doesn’t just handle payments; it also helps you understand your customers better, creating experiences that keep them coming back. This level of service can build strong customer relationships and encourage loyalty.

Having a POS system that can grow and change with your business is crucial. As you expand or shift focus, your system should easily adjust to new requirements, whether that’s integrating new technology or reaching out to a broader audience. The right system will support your journey, keeping you competitive and forward-thinking in a world that’s always changing.

As you navigate the world of payment processing, remember that choosing the right POS system is a critical decision that can significantly impact your business’s success. By understanding your unique needs, evaluating key features, and considering the benefits of mobile and online payment solutions, you can select a system that streamlines operations, enhances customer experiences, and drives growth.

Related Frequently Asked Questions

How do I choose the right POS system for my business?

Consider your business type, payment volume, hardware needs, software integrations, support options, and contract terms. Pick a system that scales and aligns with your workflow and customer touchpoints.

What features should a modern POS system include?

Look for inventory tracking, multi‑payment acceptance, analytics dashboards, mobile compatibility, employee management, and support for loyalty and gift programs.

What are the costs associated with POS systems?

Costs may include monthly or yearly software subscriptions, hardware purchases or rentals, transaction and service fees, setup costs, and optional add‑on features like customer display screens or tablets.

Quinn Davis has over 20 years of leadership experience in payments and financial services, with deep expertise in digital transformation and cross-border strategy. As SVP of Global Payments Strategy at a multinational platform, Quinn oversees product expansion into emerging markets and optimization of cross-border infrastructure. She’s recognized for modernizing legacy systems and mentoring the next generation of women in fintech.