The payments landscape is evolving at an unprecedented pace, with new technologies and shifting consumer expectations reshaping how we transact. As we look ahead to 2025 and beyond, several key trends are poised to define the future of fintech.

From the rapid adoption of real-time payments to the rise of embedded finance, these developments are creating new opportunities for businesses to streamline operations, enhance customer experiences, and drive growth. At the same time, the increasing sophistication of fraud attempts and the evolving regulatory landscape present challenges that require proactive strategies and robust solutions.

In this article, we’ll explore the top digital payment trends that are shaping the fintech industry, examining their implications for ISOs, software companies, unattended integrators, and payment facilitators. By understanding these trends and adapting to the changing landscape, organizations can position themselves for success in the dynamic world of digital payments.

The Rise of Real-Time Payments

The demand for instant gratification is driving a seismic shift toward real-time payments. Consumers and businesses alike expect transactions to be processed immediately, with funds available in their accounts within seconds. This need for speed is fueling the adoption of faster payment rails like FedNow and RTP (Real-Time Payments).

FedNow, the Federal Reserve’s instant payment service, is rapidly gaining traction since its launch in 2023. In Q4 of 2024 alone, FedNow processed an average of $190 million in payments per day, signaling strong demand for real-time transactions. Similarly, The Clearing House’s RTP network has seen impressive growth, with payment volume increasing by 94% in 2024 to reach $246 billion.

The benefits of real-time payments extend beyond speed. Instant payment rails enable businesses to optimize cash flow, reduce administrative costs, and enhance customer satisfaction. For example, one-click checkout experiences powered by real-time payments can significantly reduce cart abandonment rates. While over 70% of carts are abandoned during multi-step checkouts, one-click experiences bring this down to under 1%, particularly for mobile in-app purchases.

As real-time payment adoption accelerates, ISOs and software companies must adapt their offerings to support these faster payment rails. This may involve integrating with platforms like NMI that offer seamless connectivity to instant payment networks. By embracing real-time payments, businesses can differentiate themselves in an increasingly competitive market and meet the evolving needs of their customers.

Embedded Finance Goes Mainstream

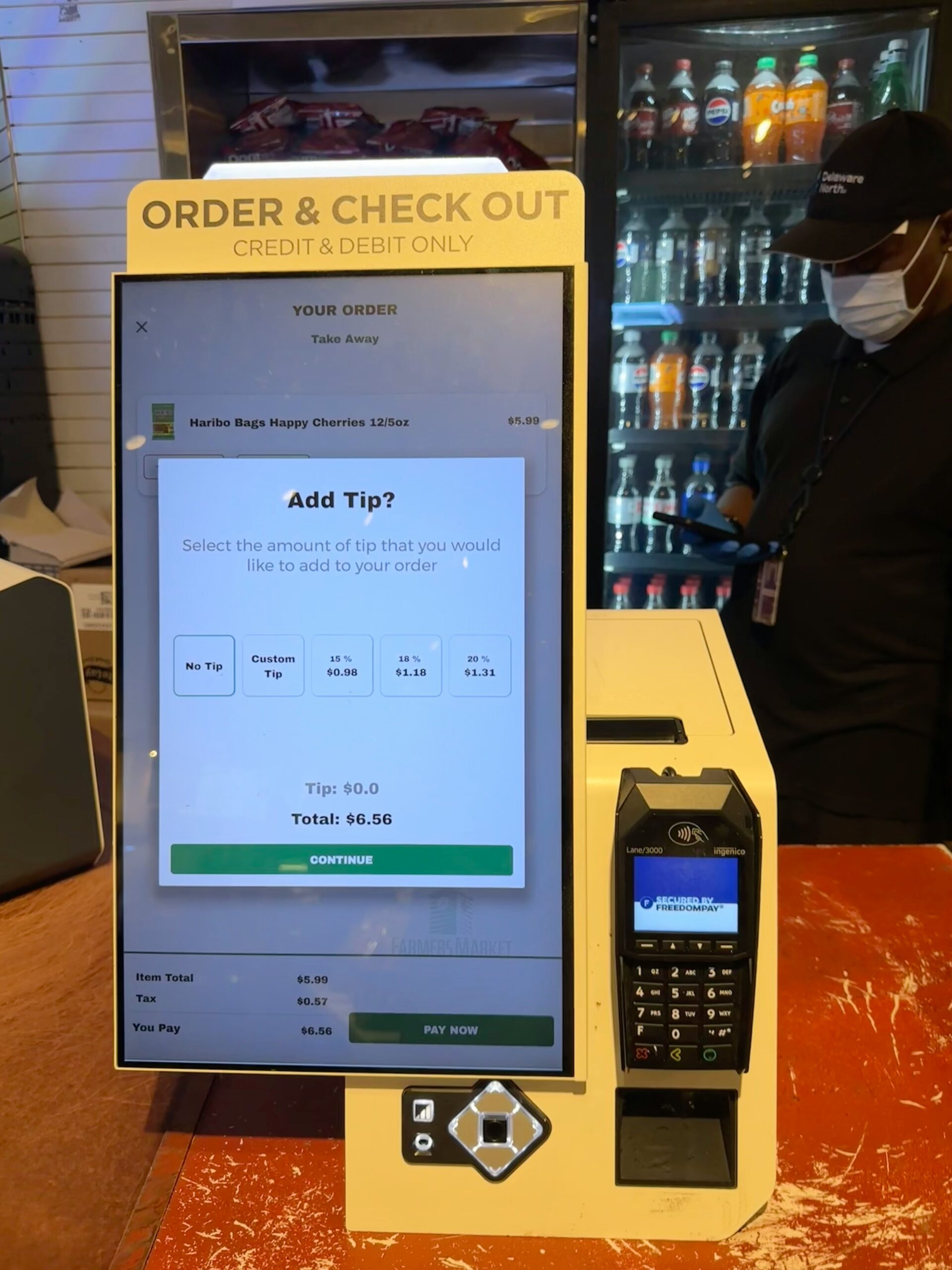

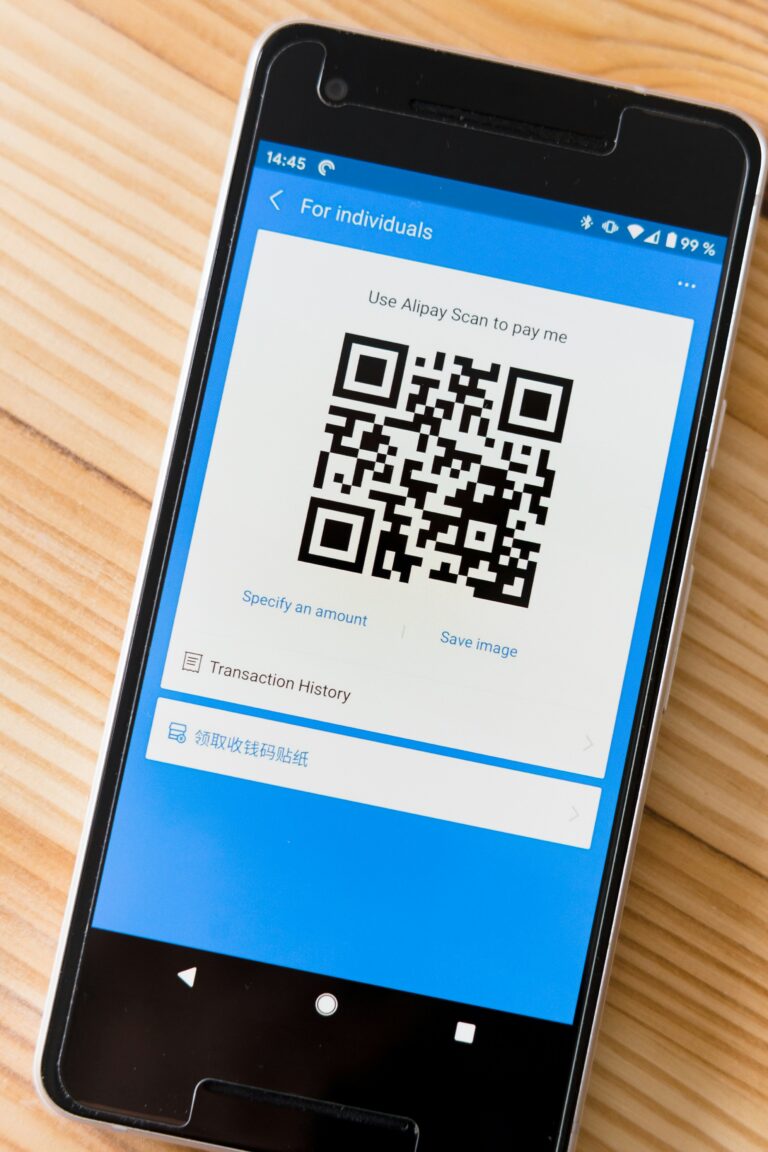

Embedded finance is reshaping the delivery of financial services by seamlessly integrating them into everyday platforms, enhancing user experiences. This evolution transforms transactions into unobtrusive elements of the consumer journey, aligning with the increasing demand for convenience and efficiency. As businesses embed financial solutions into their offerings, they create value-added services that meet modern consumer expectations for streamlined interactions.

A notable advancement in embedded finance is the integration of automated credit solutions. Utilizing real-time analytics, these solutions can instantly evaluate consumer eligibility, offering tailored financial products without the traditional wait times. This innovation simplifies credit access and elevates the customer experience by eliminating cumbersome processes and accelerating approvals. For businesses, providing instant financing options boosts sales and improves customer satisfaction, particularly in dynamic sectors such as e-commerce and digital marketplaces.

Additionally, customer-centric embedded finance options, like flexible payment plans, are revolutionizing the way consumers manage their purchases. By offering installment payments directly within the purchasing process, businesses can cater to diverse financial needs, enhancing customer loyalty and engagement. This approach not only aids consumers in managing expenses but also expedites cash flow for businesses, reducing the potential for payment delays. For ISOs and technology providers, incorporating these features into their solutions offers a competitive advantage, appealing to merchants seeking adaptive payment options that align with contemporary consumer expectations.

AI Transforms Fraud Prevention and Personalization

The integration of artificial intelligence into the fintech landscape is setting new benchmarks in fraud prevention and enhancing personalized consumer experiences. Advanced analytical models are now capable of scrutinizing transaction data with unprecedented speed and accuracy. This capability enables businesses to proactively intercept fraudulent activities as they unfold, significantly bolstering security frameworks. By swiftly identifying and addressing irregularities, these AI systems protect financial assets and maintain consumer confidence.

Generative AI is redefining the efficiency of payment systems by automating intricate processes and minimizing the need for human oversight. This results in a more seamless transaction experience and greater operational efficiency. With the automation of routine tasks, businesses can achieve faster transaction processing times and reduce the risk of errors. This advancement not only optimizes operations but also contributes to a more fluid and reliable user experience.

AI-driven solutions are also paving the way for deeper personalization in financial services. By harnessing comprehensive data insights, these tools offer consumers recommendations and payment solutions that are finely tuned to their individual habits and preferences. For example, AI can tailor risk assessments and suggest custom loyalty programs or payment plans that resonate with a consumer’s financial behavior. This level of personalization strengthens customer loyalty, as users gravitate towards platforms that intuitively meet their specific needs and preferences.

The Evolving Regulatory Landscape

The regulatory framework for digital payments is undergoing profound changes, driven by a focus on enhancing transparency, security, and consumer trust. In Europe, the introduction of Payment Services Directive 3 (PSD3) marks a significant evolution in how fintech companies must operate. This directive seeks to bolster the security of digital transactions and increase consumer confidence, while simultaneously encouraging innovation and competition within the financial services industry. For fintech businesses, aligning with these regulations involves a strategic approach that balances compliance with the need to maintain their innovative edge.

A significant development on the global stage is the implementation of ISO 20022, which aims to create a cohesive standard for payment messaging across international borders. This initiative is designed to simplify the complex landscape of payment communication, resulting in more efficient and transparent transactions worldwide. By standardizing payment data, ISO 20022 facilitates seamless interaction between financial institutions, minimizing errors and enhancing transaction speed and reliability. This standard is poised to become the cornerstone of global payment infrastructure, presenting fintech companies with the opportunity to achieve greater integration with international payment systems.

As regulations continue to evolve, fintechs must adeptly address the challenges and opportunities these changes present. This involves not only ensuring compliance with new standards but also leveraging them to enhance operational efficiency and customer satisfaction. By adopting cutting-edge compliance technologies and embedding them within their operations, fintech companies can streamline adherence to regulations while driving innovation. The ability to adapt to regulatory developments and incorporate them into business strategies will be crucial for fintechs aiming to sustain a competitive advantage in the ever-changing digital payments landscape.

Biometric Authentication and Voice Payments

The implementation of biometric authentication in payment systems is revolutionizing security by providing a unique and personal method of verifying identities. Innovations like iris scans and voice recognition are enhancing transaction security while offering speed and ease that traditional methods lack. These advanced biometric techniques minimize the risk associated with data breaches by ensuring that only the authorized user can initiate a transaction, thereby fostering greater consumer trust and satisfaction.

The burgeoning field of voice-activated payments is poised for significant growth, with market projections reaching $164 billion by 2025. This technology facilitates transactions through voice commands, enabling consumers to make payments without physical interaction. The convenience of voice payments is especially advantageous in situations where hands-free operation is essential, such as during travel or when multitasking. The proliferation of digital assistants and smart home devices further supports the integration of voice payments into everyday life, making them an attractive option for tech-savvy consumers.

Smart devices, now equipped with cutting-edge biometric capabilities, are at the forefront of this payment evolution. These devices not only enhance transaction security but also deliver a futuristic and seamless user experience. As consumers prioritize convenience and innovation, the convergence of biometric and voice payment technologies in smart devices emerges as a crucial differentiator for businesses seeking to lead in the digital payment space. This evolution towards advanced, user-centric authentication methods underscores the fintech industry’s commitment to creating intuitive and secure payment solutions.

The Future is Programmable with Smart Contracts

Smart contracts are revolutionizing the financial ecosystem by automating intricate transaction procedures, thereby enhancing speed and accuracy. These digital agreements automatically execute specified actions when set conditions are fulfilled, streamlining operations by removing intermediaries. This approach not only expedites transactions but also solidifies security measures, reducing the likelihood of disputes and promoting operational precision.

The rise of programmable money is enabling businesses to redefine how they manage billing and payments. By utilizing smart contracts, companies can seamlessly implement automatic recurring billing, manage subscriptions, and accommodate usage-based payments. This innovation ensures that transactions are conducted with precision and regularity, optimizing cash flow and reducing administrative overhead. For consumers, the convenience of automated processes enhances their overall experience, building trust and loyalty with service providers.

Fintech firms that incorporate smart contract platforms into their services are poised to explore novel revenue opportunities and adaptive business models. Through these technologies, businesses can offer advanced services like dynamic pricing, instantaneous settlement, and conditional payments, which align with the changing demands of consumers and enterprises. As the fintech industry continues to advance, smart contracts emerge as a crucial innovation, equipping organizations to rethink their financial strategies and embrace the cutting edge of digital finance.

Stablecoins and CBDCs Redefine Digital Currency

The digital currency arena is witnessing a paradigm shift with the rapid integration of stablecoins and the advent of Central Bank Digital Currencies (CBDCs). Stablecoins, known for their stability by being pegged to less volatile assets like fiat currencies, are establishing themselves as pivotal in the digital payment ecosystem. With an impressive annual payment volume of $2.5 trillion, stablecoins offer a resilient alternative to conventional cryptocurrencies, facilitating everyday transactions with consistent value. Their appeal extends to international transactions, where they provide a cost-effective and swift solution, significantly streamlining remittances and cross-border financial exchanges.

CBDCs represent a groundbreaking development in digital currency, introducing a digital format of government-backed money. These currencies enable central banks to leverage blockchain technology’s benefits while retaining control over monetary policies and ensuring economic stability. CBDCs can revolutionize payment procedures by lowering transaction costs and broadening access to financial services, especially in regions with limited banking infrastructure. As nations pilot and explore CBDC implementation, the global financial ecosystem is on the brink of a transformative shift, where digital currencies enhance and diversify the existing monetary systems, offering a range of payment options for consumers and enterprises alike.

For financial service providers aiming to remain at the cutting edge, integrating stablecoins and CBDCs into their payment systems is crucial. By embracing these digital currencies, payment providers can deliver advanced solutions that cater to the needs of a digitally-forward clientele. This integration is essential for businesses to future-proof their operations, ensuring they are equipped to handle the evolving demands of a financial landscape where digital currencies are integral to secure and efficient transactions. As the adoption of stablecoins and CBDCs gains momentum, financial entities must strategically align their offerings to harness these innovations, positioning themselves as leaders in the digital currency domain.

As the digital payment landscape continues to evolve, businesses must adapt and embrace these trends to remain competitive and meet the changing needs of their customers. By leveraging the latest technologies and partnering with experienced payment providers, organizations can navigate this dynamic landscape and unlock new opportunities for growth and innovation.

Related Frequently Asked Questions

What are real-time payments, and why are they growing?

Real-time payments enable instant fund transfers between bank accounts. Their growth is fueled by demand for faster transactions, improved cash flow, and enhanced customer experience, with platforms like FedNow and RTP driving adoption.

How is embedded finance changing the payment landscape?

Embedded finance integrates financial services directly into non-financial platforms, streamlining user experiences. Examples include in-app lending, buy-now-pay-later options, and instant credit evaluations.

What role does AI play in digital payments?

AI helps detect fraud in real-time, personalize user experiences, and automate back-end processes. Generative AI also supports smarter transaction handling and dynamic risk assessment.

What is PSD3, and how does it affect fintech companies?

PSD3 is the latest European directive aimed at increasing security and transparency in digital payments. It promotes competition and mandates stronger data protection, impacting how fintechs manage compliance and innovation.

Are biometric and voice payments secure?

Yes. Biometric methods like fingerprint or iris scans, along with voice authentication, offer secure and convenient ways to authorize transactions. They minimize the risk of data breaches while enhancing UX.

How do smart contracts improve payment processing?

Smart contracts automate payment workflows based on predefined conditions. They reduce reliance on intermediaries, speed up settlement, and enable features like dynamic billing and usage-based pricing.

What’s the difference between stablecoins and CBDCs?

Stablecoins are privately issued digital assets pegged to fiat currencies, while CBDCs are government-backed digital versions of national currencies. Both aim to modernize transactions and reduce cross-border payment friction.