Starting a business involves many moving parts, but one of the most critical components is setting up a reliable payment processing system. Accepting payments from customers is the lifeblood of any business, whether you’re selling products online, providing services in-person, or a combination of both.

Getting started with payment processing may seem daunting at first, especially for those new to the world of business. However, with the right guidance and tools, you can set up a seamless payment system that not only meets your customers’ needs but also helps your business thrive.

In this article, we’ll walk you through the essentials of payment processing and provide actionable steps to get you up and running quickly. We’ll cover everything from understanding the payment processing landscape to choosing the right payment processor and integrating it into your business.

What is Payment Processing?

Payment processing is the backbone of how businesses accept payments, whether online or in-person. It involves a complex network of systems and services that work together to handle transaction details swiftly and securely.

Imagine payment processing as the silent workhorse, ensuring your customer’s payment gets from their hands to your business account without a hitch. When a customer makes a purchase, the payment processor captures their payment information, verifies it, and then transfers the funds to your merchant account. This all happens in a matter of seconds, thanks to the sophisticated technology behind payment processing.

Understanding the key players in the payment processing ecosystem is crucial:

- Payment Processor: This is the company that handles the actual processing of transactions. They communicate with the customer’s bank, your bank, and the card networks to ensure the payment is authorized and the funds are transferred correctly. Well-known payment processors include companies like NMI, which offers a comprehensive suite of payment processing solutions.

- Payment Gateway: A payment gateway is like a virtual point-of-sale terminal for online transactions. It securely captures the customer’s payment information, encrypts it, and sends it to the payment processor for authorization. Payment gateways are essential for ecommerce businesses.

- Merchant Account: This is a special type of bank account that allows businesses to accept credit and debit card payments. The funds from card transactions are first deposited into the merchant account before being transferred to your main business bank account.

By understanding these key components, you’ll be better equipped to navigate the payment processing landscape and make informed decisions for your business.

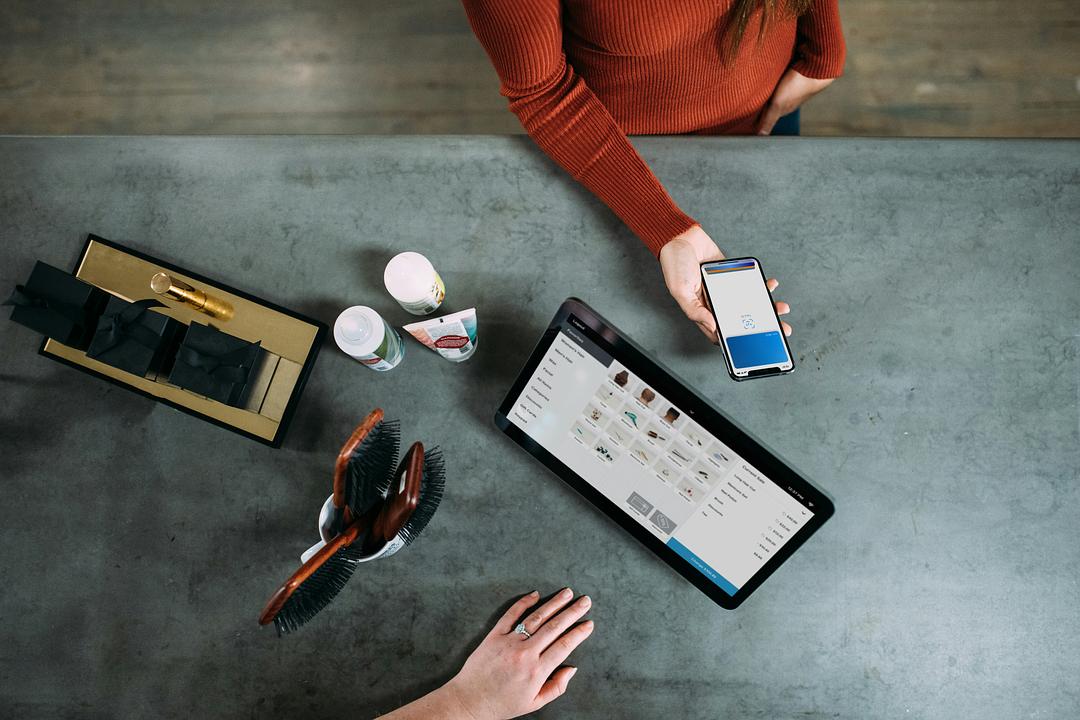

Before you start accepting payments, it’s vital to get a handle on what your business needs and how your customers like to pay. This means figuring out whether your clientele prefers to swipe a card, tap their phone, or use a digital wallet for convenience.

Identifying Customer Payment Preferences

Grasping how your customers prefer to pay helps you tailor your payment processing system. If your audience is tech-savvy, make sure you offer options like mobile payments. For those who lean more traditional, having credit and debit card processing might just do the trick.

- Credit Cards: A staple for many, offering security and ease.

- Mobile Payments: Appeals to those who appreciate speed and simplicity.

- Digital Wallets: Options like PayPal and Apple Pay are becoming popular for their ease and security.

Evaluating Your Business Needs

Once you know what your customers want, focus on what your business needs to operate smoothly. Consider how often you process transactions, the kind of products or services you offer, and your overall business model. Are you a small shop or a bustling online store? Each has its own set of requirements.

- Transaction Volume: If you’re processing many transactions, look for processors with competitive fees.

- Nature of Sales: If you’re in subscriptions, you’ll need a system that handles recurring payments seamlessly.

- Business Model: E-commerce businesses might prioritize strong online payment solutions, while physical locations could focus on in-person systems.

Setting the Foundation

With customer preferences and business needs in mind, you can lay the groundwork for your payment processing system. This involves picking a payment processor that matches your business ambitions and is easy to integrate.

Finding the right payment processor is like finding the right partner in business. You need reliability, efficiency, and a suite of services that fit your needs. Ensure your processor provides solid support and security, allowing you to focus on delivering great service to your customers without getting bogged down in the technical details.

Step 1: Choose the Right Payment Processor

Picking a payment processor is an important choice that can shape how efficiently your business runs. The processor should match your business’s scale and needs, providing the flexibility and features necessary for smooth transactions. Think of it as selecting the right tool that enhances your business operations.

Understand Costs and Fees: Start by getting a clear picture of the costs involved. Transaction fees can differ greatly among processors and usually depend on your transaction volume and type. For a business that handles many transactions, even a small fee difference can add up. Evaluate if there are any extra charges, like setup fees or monthly costs, that could impact your expenses.

- Transaction Fees: Usually, this is a small cut of each sale plus a flat fee. It’s important to compare these against your typical sales volume.

- Monthly Costs: Some processors charge a regular fee, no matter your sales. Make sure these fit your budget.

- Additional Charges: Watch out for unexpected fees, such as those for chargebacks, which can arise unexpectedly.

Integration Simplicity: Your chosen processor should work well with your current systems. This includes your checkout systems, online store, and bookkeeping software. A processor that integrates easily reduces hassle and saves time in setting up and maintaining your payment systems. Look for those that offer comprehensive support, which can make integration straightforward.

Variety of Payment Options: The processor should support various payment types to meet your customers’ preferences. This includes cards, mobile payments, and digital wallets. Offering different payment options not only improves customer satisfaction but also decreases the chances of abandoned purchases due to limited payment choices.

- Credit and Debit Cards: Ensure support for major card brands to appeal to a wide customer base.

- Mobile Payments: With the increase in mobile shopping, offering mobile payment options can give you an edge.

- Digital Wallets: Options like PayPal and Apple Pay are gaining popularity and can make transactions more convenient for customers.

By examining these factors closely, you can select a payment processor that not only fits your current needs but also supports your business as it grows.

Step 2: Set Up a Merchant Account

Creating a merchant account is crucial for managing payments from credit and debit cards. This account works as a temporary holding place for funds earned from sales. Once a transaction is processed, the funds sit in the merchant account before moving to your regular business account, ensuring everything runs smoothly.

Understanding the Merchant Account: Picture a merchant account as a key part of your payment process, linking your business to the customer’s bank. When a customer pays, the money goes into this account first. This step makes sure the transaction is secure and sets the stage for transferring the funds to your main bank account, keeping your business operations steady.

Choosing the Right Merchant Account Provider: Finding a provider that syncs well with your payment processor is essential to prevent any hiccups. This smooth connection helps transactions happen quickly and without errors, making things easier for your customers. Check out any costs related to the merchant account, like fees for transactions and other charges.

- Transaction Fees: Usually a small cut of each sale, it’s important these fees fit your business’s needs.

- Monthly Charges: Some providers charge a set fee every month, so see if this fits your budget.

- Extra Services: Look for services that help your business, like tools to prevent fraud or support for different currencies.

Streamlining the Setup Process: Setting up a merchant account means having your business documents ready, like your business license and bank statements. This helps show your business is legitimate and speeds up approval. After you’re set up, run a few test transactions to make sure everything works before you start using it for real. This preparation helps avoid any issues later, keeping your business running smoothly.

Step 3: Integrate a Payment Gateway

Setting up a payment gateway is key in managing how your business handles transactions. It serves as the link between your business and the customers, managing the transaction process while ensuring security. The gateway takes in the customer’s payment details, secures them, and forwards them to the processor for approval. This all happens quickly and smoothly, thanks to the gateway’s efficiency.

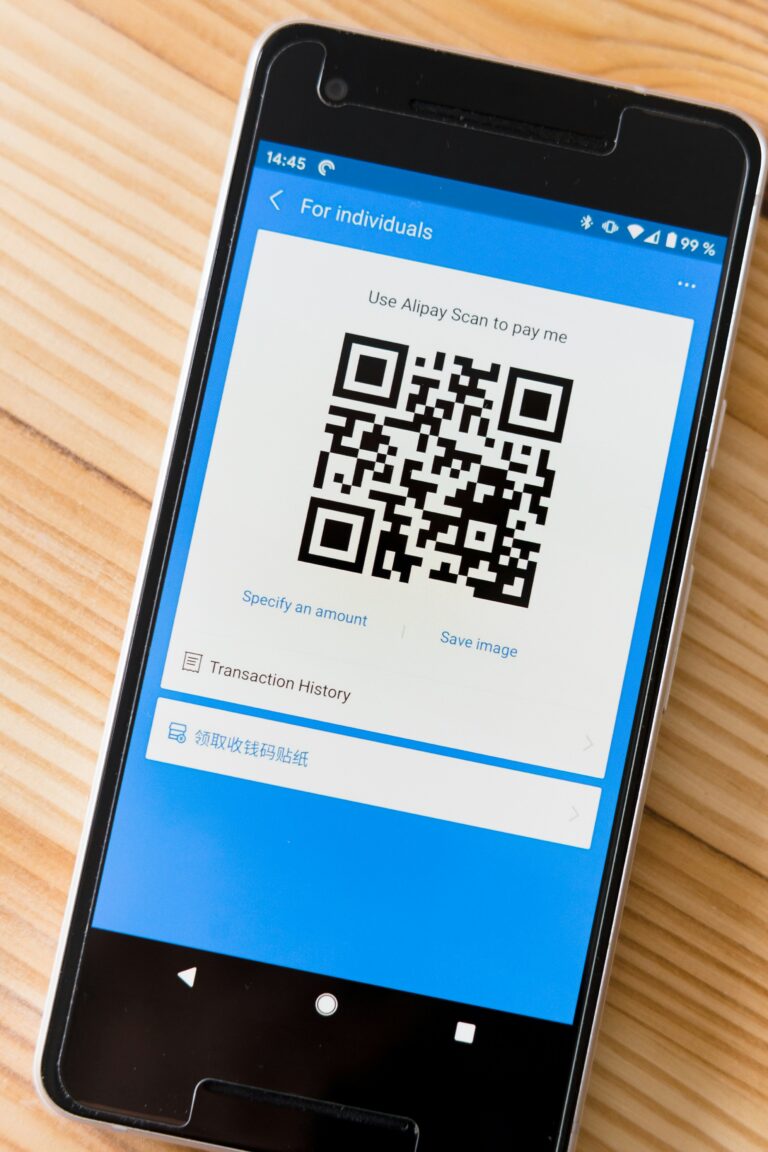

Picking a Suitable Payment Gateway: Choosing the right gateway can have a big effect on your business. It’s important to find one that meets your needs and supports the payment methods your customers use. A reliable gateway should handle different currencies and payment types, especially if you’re planning to expand your business internationally. This flexibility not only keeps your customers happy but also helps you reach new markets.

- Currency Handling: If you’re selling internationally, make sure your gateway can process payments in multiple currencies. This feature allows you to serve a wider range of customers without worrying about converting currencies.

- Variety in Payment Methods: Look for a gateway that supports a range of payment options, like credit cards, digital wallets, and mobile payments. Offering these choices makes it easier for customers to complete their purchases, which can help reduce the number of abandoned carts.

Smoothing the Integration Process: The gateway should integrate easily with your current systems, causing little to no disruption. It should work well with your online store, checkout systems, and any other software you use. Seek out a gateway that offers plenty of support, making the integration process as simple as possible. This smooth setup not only makes transactions easier but also boosts how efficiently your business runs.

By ensuring security and ease of use, integrating a payment gateway becomes a strategic move for your business, providing a secure and easy checkout process for your customers.

Step 4: Test Your Payment System

Testing your payment system is essential before opening your business to customers. This phase allows you to spot potential issues and fine-tune the system, ensuring smooth transactions from start to finish. Think of it as a practice run, where you fix any problems before the main event.

Simulate Real Transactions: Begin by running practice transactions that mimic real-world scenarios. This includes processing different types of payments—credit cards, digital wallets, and mobile transactions—to make sure your system handles each smoothly. Testing helps verify that all parts of the payment process work together, minimizing the risk of disruptions.

- Sales Transactions: Test transactions of various sizes to see how your system handles different amounts. Ensure that each transaction goes through without issues, confirming that the funds are processed correctly and reach your account as expected.

- Refunds and Cancellations: It’s also important to test how your system manages refunds and cancellations, as these are common in any business. Make sure that refunds process smoothly and that customers receive their money back without unnecessary delays.

Monitor Security and Compliance: While testing, closely check security measures. Ensure that sensitive information, like customer payment details, is kept safe throughout the transaction process. Confirm that your system meets industry standards for protecting against fraud and data breaches.

Evaluate User Experience: The testing phase is also a chance to assess how easy and pleasant the checkout process is for customers. Walk through the process as if you were a customer—consider factors like ease of use, clarity of instructions, and speed of transactions. This perspective helps identify areas for improvement, enhancing the overall user experience.

By thoroughly testing your payment system, you prepare for a reliable and efficient checkout experience. This preparation ensures that when customers begin making purchases, the process is straightforward and hassle-free, reflecting positively on your business.

Step 5: Launch and Monitor

Putting your payment system into action is an exciting step. You’ve prepared and tested everything—now it’s time to let customers start using it. This moment is both a significant milestone and the beginning of real-world operations.

Open for Business: With testing complete, you can now make your payment system available to your customers. Ensure that all features are ready for real transactions and that everything works as planned. Go through all the settings one last time to make sure they fit your business needs. Launching smoothly means you’ve addressed any issues beforehand, allowing for a hassle-free customer experience.

Keep an Eye on Transactions: Once live, it’s crucial to watch how transactions flow through your system. Regularly check to see that everything is working correctly and there aren’t any snags. By doing this, you can catch and fix potential issues quickly, keeping everything running smoothly.

- Transaction Monitoring: Regularly view transaction data to understand how customers are using your system. This helps you spot any unusual patterns and make informed decisions about changes or improvements.

- Issue Tracking: Stay alert for any transaction errors and resolve them promptly to maintain trust and reliability in your service.

Listen to Customer Feedback: Paying attention to what customers say about their experience is key to making improvements. Encourage them to share their thoughts, whether through feedback forms or casual conversations. This insight helps you see where you can make things better and keep customers happy.

- Feedback Channels: Make it easy for customers to tell you what they think. Whether it’s a quick survey or a suggestion box, make sure they know their opinions are valued.

- Continuous Improvement: Use what you learn from feedback to fine-tune your system. Regular adjustments help you stay aligned with what your customers need and expect.

Launching and monitoring your payment system effectively lays a solid foundation for success. By actively engaging with your system and your customers, you create an environment where your business can thrive.

Final Thoughts

Embarking on the journey to accept payments is a significant step for any business. A well-planned payment system goes beyond meeting customer needs—it lays the groundwork for your business to expand and flourish. This setup not only enhances customer satisfaction but also equips your business for future challenges.

Laying the Foundation for Growth: Picking the right partners for your payment needs is crucial. Whether it’s the technology you choose or the services you integrate, these decisions directly impact how smoothly your operations run. A reliable partner provides essential support and adapts to your business requirements, ensuring that your payment process remains seamless.

- Dependable Partnerships: Select providers known for their solid track record and customer service. They become an extension of your team, helping you navigate the complexities of payment processing with ease.

- Flexible Systems: Opt for solutions that can adjust as your business grows, handling increased transactions and offering diverse payment options to keep up with customer preferences.

Ongoing Improvement: Managing payments isn’t a one-time task. Regular updates and refinements keep your system in tune with the latest advancements and customer expectations. This continuous enhancement is key to maintaining a smooth and effective payment process.

- System Updates: Keep your software current to benefit from the latest features and security improvements. This proactive approach safeguards your operations and optimizes performance.

- Customer Feedback: Use insights from customer experiences to fine-tune your system. Listening to your customers helps you make meaningful improvements that enhance their satisfaction and loyalty.

By focusing on these elements, you create a robust payment system that supports your business objectives and adapts to the ever-changing landscape of commerce.

Related Frequently Asked Questions

What steps are involved in getting started with payment processing?

First, choose a payment provider and merchant account. Set up a gateway or POS system, integrate with your platform, configure risk and fraud controls, and conduct live transaction testing before launching.

What documentation is required to set up payment processing?

You’ll typically need your business license or registration, tax identification or EIN, bank account information, expected monthly volume, average transaction size, and product or service descriptions.

How long does it take to be fully operational?

The setup timeline varies—but most small businesses are ready within a few days to a week, while high-risk or high-volume merchants may take longer for underwriting and approval.

David McCallister is a seasoned financial strategist with over three decades of experience in corporate finance, treasury operations, and M&A. As CFO of a global fintech infrastructure provider, David guides strategic financial planning and has helped lead companies through IPOs and PE-backed growth. Known for aligning capital with vision, he serves on several boards focused on fintech innovation and financial inclusion.