The payments landscape is evolving at an unprecedented pace, driven by technological advancements and shifting consumer preferences. As businesses navigate this dynamic environment, understanding payment insights has become more critical than ever.

Payment insights offer a window into consumer behavior, market trends, and operational efficiency. By leveraging data-driven analytics, businesses can make informed decisions that drive growth, improve customer experiences, and maintain a competitive edge.

In this article, we’ll explore the concept of payment insights, their significance in today’s business world, and how companies can harness the power of payment data to thrive in the digital age. Get ready to dive into the world of payment analytics and discover the untapped potential that lies within your transaction data.

What Are Payment Insights and Why Do They Matter?

Payment insights refer to the actionable intelligence and data-driven analysis derived from payment transactions and consumer behavior. These insights provide a deep understanding of customer preferences, spending patterns, and market trends, enabling businesses to make informed decisions and optimize their strategies.

The importance of payment insights cannot be overstated in today’s competitive business landscape. By leveraging payment analytics, companies gain visibility into:

- Customer preferences: Insights reveal which payment methods customers prefer, helping businesses offer the most convenient options and enhance the customer experience.

- Spending patterns: Analyzing transaction data uncovers trends in customer spending habits, enabling targeted marketing efforts and personalized offerings.

- Market trends: Payment insights shed light on emerging market trends, allowing businesses to adapt their strategies and stay ahead of the curve.

Harnessing the power of payment insights is crucial for businesses to remain competitive and meet evolving consumer expectations. Companies that effectively utilize payment data can:

- Improve decision-making by basing strategies on data-driven insights rather than assumptions

- Identify growth opportunities by uncovering high-performing products, services, or customer segments

- Enhance customer loyalty by delivering personalized experiences and rewards based on individual spending behaviors

- Optimize operations by streamlining payment processes, reducing fraud, and improving efficiency

In essence, payment insights provide a powerful tool for businesses to understand their customers, make informed decisions, and drive sustainable growth. As the payments industry continues to evolve, with innovative solutions like those offered at NMI, the ability to leverage payment data will become increasingly critical for success in the digital age.

Top Payment Trends Shaping the Future

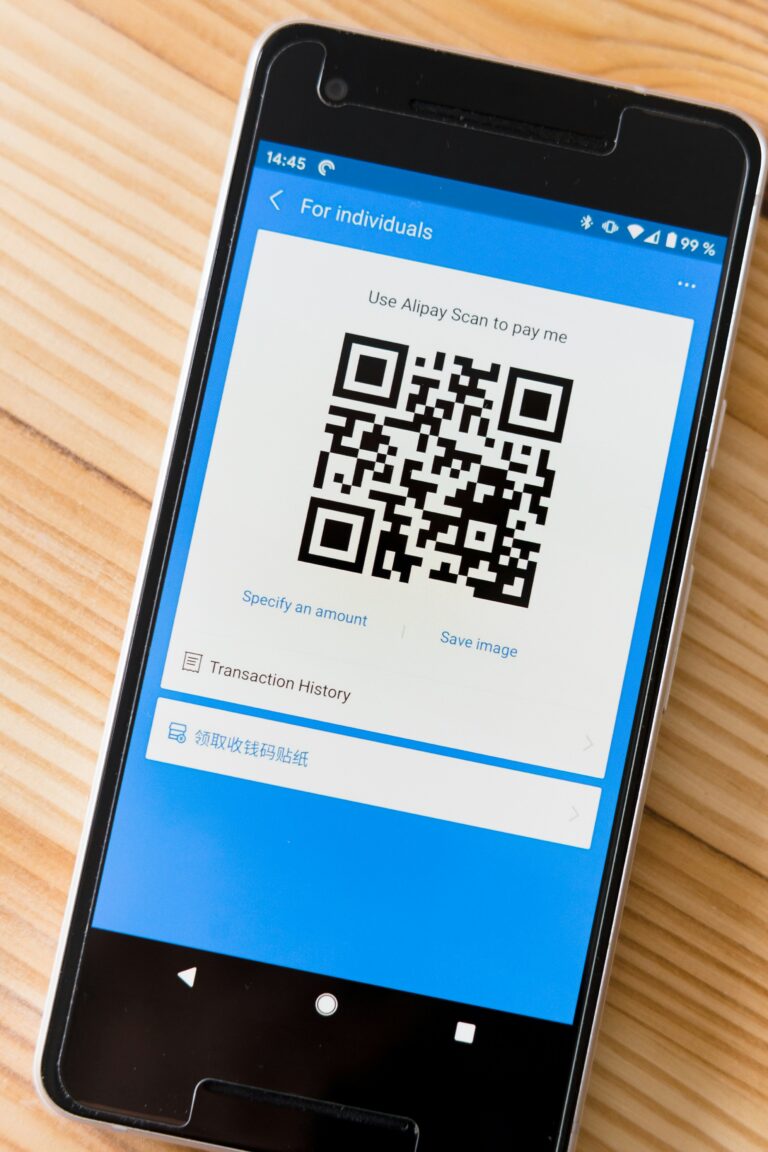

The payments sector is experiencing a transformative wave, marked by the widespread adoption of advanced payment technologies. Innovations such as mobile wallets, QR codes, and biometric authentication are taking center stage. This shift underscores a growing consumer appetite for streamlined, efficient transactions, driving businesses to integrate these methods into their offerings. The result is a more cohesive digital ecosystem where payments become an intuitive part of daily life.

Embedded payment solutions are rapidly expanding beyond traditional financial settings. By integrating payment capabilities into apps, connected devices, and vehicles, businesses are redefining the purchasing process. This integration allows consumers to complete transactions seamlessly within the platforms they use, enhancing convenience and engagement. For companies, this represents an opportunity to unlock new revenue channels and create a more integrated customer experience.

The rise of alternative payment options is reshaping consumer choice. With the increasing popularity of buy now, pay later (BNPL) schemes and account-to-account transfers, consumers are empowered with flexibility in managing their finances. These alternatives cater to the demand for adaptable financial solutions, which in turn can drive customer acquisition and loyalty. Businesses that embrace these options are well-positioned to capture a diverse customer base.

Real-time payments and open banking are ushering in a new era of financial transparency and speed. The ability to instantly transfer funds and securely access financial data is revolutionizing business and consumer interactions with money. This transformation enhances cash flow management and offers greater control over financial decisions. As open banking continues to evolve, businesses can harness customer insights to deliver tailored services and deepen customer relationships.

In this landscape of innovation, the focus on security, fraud prevention, and data privacy remains paramount. With digital transactions on the rise, safeguarding sensitive information is more crucial than ever. Companies must implement advanced security protocols to protect customer data and maintain trust. By prioritizing these elements, businesses can mitigate risks and bolster their standing in the industry. As payment technologies evolve, staying informed about these trends is essential for achieving success in the digital marketplace.

Leveraging Payment Data for Business Insights

Exploring the depths of payment data unveils a wealth of strategic opportunities for businesses. By meticulously analyzing transaction details, companies can gain a nuanced understanding of customer preferences and behaviors. This knowledge serves as a foundation for crafting strategies that drive innovation and align with anticipated market shifts.

Transaction analytics empower businesses to refine their marketing initiatives with precision. By leveraging insights into consumer patterns, companies can develop campaigns that are not only targeted but also resonate deeply with their customer base. Beyond marketing, these insights extend to refining pricing models and optimizing inventory, ensuring that stock levels are aligned with actual consumer demand and reducing the risk of overstock or shortages.

In the realm of strategic expansion, payment insights are invaluable. They enable businesses to pinpoint which locations or products yield the highest returns, guiding resource allocation and market exploration with confidence. For instance, a detailed analysis of transaction data might highlight emerging trends or underserved markets, providing a roadmap for targeted growth and expansion efforts.

Integrating payment data with comprehensive business intelligence tools offers a panoramic view of company performance. This integration allows businesses to correlate customer interactions with sales trends and operational efficiencies. Leveraging these correlations, companies can enhance their decision-making processes, streamline operations, and deliver unparalleled customer experiences. When viewed through this expansive lens, payment data becomes a catalyst for sustained innovation and competitive advantage.

Enhancing the Customer Experience with Payment Insights

Leveraging payment insights allows businesses to refine the customer journey by adapting transaction processes to align with consumer behaviors. By analyzing transaction data, companies can identify which payment methods resonate most with their customers. This knowledge enables businesses to streamline their offerings, ensuring that every transaction is as efficient and intuitive as possible.

Optimizing the checkout process involves pinpointing inefficiencies and obstacles that could lead to customer frustration. Payment insights provide a comprehensive view of transaction flows, enabling businesses to fine-tune their systems and remove bottlenecks. This optimization not only enhances the user experience but also minimizes the chances of cart abandonment, leading to increased sales completion rates.

Tailoring experiences through the use of payment insights enables companies to develop dynamic reward systems and personalized incentives. By examining spending patterns, businesses can craft loyalty programs that are directly in line with customer interests. This approach not only fosters a sense of personalization but also strengthens customer relationships, encouraging continued engagement and repeat purchases.

Incorporating cutting-edge security measures is imperative for maintaining customer trust and safeguarding financial transactions. Payment insights play a crucial role in detecting unusual patterns and potential threats, allowing businesses to act swiftly and decisively. By employing advanced analytics for fraud detection, companies can provide a secure environment that reinforces customer confidence and maintains the integrity of their brand.

Staying Ahead of the Competition with Payments Innovation

Pioneering new payment technologies allows businesses to carve out a unique niche in a crowded marketplace. By integrating groundbreaking methods, companies can establish themselves as leaders in innovation, capturing the interest of consumers who prioritize advanced, seamless payment experiences. This strategic adoption not only elevates brand status but also aligns with the preferences of digital-first customers eager for intuitive solutions.

Collaboration with fintech innovators opens doors to a wealth of cutting-edge payment solutions. These partnerships provide access to pioneering tools and insights that can redefine a company’s payment strategies. Participating in industry events and knowledge-sharing sessions—facilitated by fintech experts—keeps businesses informed of the latest technological advancements and market dynamics. This proactive approach equips companies to swiftly adapt and capitalize on emerging trends.

Offering a diverse array of payment choices is crucial for meeting the varied needs of today’s consumers. By accommodating a wide spectrum of payment preferences, businesses can enhance customer satisfaction and extend their reach to untapped markets. Embracing multiple payment solutions not only ensures flexibility but also positions companies to respond effectively to consumer demands and industry shifts.

Investment in a resilient payment infrastructure is key to sustaining agility and growth. As the payments ecosystem continues to evolve, businesses must prioritize upgrading their systems to support new capabilities and processes. This forward-looking strategy not only prepares companies for future challenges but also enables rapid adaptation to technological progress. By maintaining a dynamic infrastructure, businesses can effectively navigate and thrive in the ever-changing landscape.

Developing a Data-Driven Payments Strategy

A successful data-driven payments strategy begins with a comprehensive review of current systems to uncover inefficiencies and potential enhancements. This review should focus on pinpointing specific areas where technology can optimize processes, thus aligning operations with future business needs. By leveraging advanced analytics, companies can ensure that payment processes are not just efficient but also strategically aligned with broader industry trends.

Incorporating clear and actionable metrics is crucial for steering payment strategies that contribute to overarching business objectives. These metrics should be designed to provide a clear picture of performance, facilitating timely adjustments to strategies and ensuring alignment with the company’s long-term vision. Establishing such benchmarks allows organizations to maintain focus and measure success against clearly defined goals.

Cultivating an environment where data-driven decision-making thrives is essential for unlocking the full potential of payment insights. This involves equipping teams with the skills to interpret complex data sets and translate them into actionable strategies. By promoting data fluency across the organization, businesses can harness insights to drive innovation and foster a culture that values informed decision-making.

Regularly scanning the horizon for emerging payment trends and shifts in consumer behavior is vital for maintaining a competitive edge. This proactive approach allows businesses to anticipate changes and swiftly adapt their strategies. By staying ahead of industry developments, companies can position themselves as leaders in the evolving payments landscape.

Partnering with forward-thinking technology providers and industry leaders is critical for accessing the latest innovations in payment solutions. These collaborations offer invaluable resources and insights that can enhance strategic planning and implementation. Engaging with these partners ensures that businesses remain at the forefront of technological advancements, driving sustained growth and competitive advantage.

As the payments landscape continues to evolve, staying informed and adaptable is crucial for businesses to thrive in the digital age. By leveraging payment insights and embracing innovative solutions, companies can unlock new opportunities for growth and deliver exceptional customer experiences.

Related Frequently Asked Questions

What are payment insights and why do they matter?

Payment insights are data-driven analyses derived from transaction data and consumer behavior. They help businesses understand customer preferences, spending patterns, and market trends to make informed strategy decisions.

How can businesses use payment analytics for growth?

Businesses can tailor product offerings, improve checkout experiences, offer preferred payment methods, and identify loyal customer segments based on analytics derived from their transaction data.

Which payment trends are shaping the industry?

Key trends include increasing use of mobile wallets and QR codes, growth in BNPL and account-to-account payments, embedded payments in apps and devices, and biometric authentication.

Devon Clark blends engineering expertise with fintech strategy, bringing 15+ years of experience at the cutting edge of embedded finance. As Director of Embedded Finance & Strategic Partnerships at a leading SaaS firm, Devon has scaled revenue channels, launched GTM partnerships, and simplified complex integrations. He’s passionate about democratizing access to financial tools and regularly contributes insights on emerging trends in B2B fintech infrastructure.