The payments industry is undergoing a rapid transformation, driven by evolving consumer preferences and technological advancements. As businesses strive to enhance the customer payment experience, they are embracing digital solutions that offer convenience, security, and seamless transactions.

In this dynamic landscape, staying informed about the latest payment trends is crucial for organizations looking to remain competitive and meet the changing needs of their customers. By understanding the key drivers shaping the future of payments, businesses can make informed decisions and adapt their strategies accordingly.

As we explore the dominant trends in the payments industry, it becomes clear that digital payment options are taking center stage. Consumers are increasingly favoring methods such as credit cards, peer-to-peer (P2P) transactions, and digital wallets over traditional cash and checks.

The Dominance of Digital Payments

The rise of digital payments is a global phenomenon, with consumers embracing the convenience and flexibility offered by these methods. According to recent projections, global e-commerce sales are expected to reach a staggering $6.3 trillion by 2024. This growth is fueling the adoption of digital payment solutions, as businesses strive to meet the demands of online shoppers.

The Decline of Cash and Checks

As digital payment options gain popularity, the use of cash and checks is steadily declining. Major retailers are leading the charge towards a “check zero” future, recognizing the potential to reduce costs and mitigate fraud risks associated with traditional payment methods. P2P payment apps have seen a remarkable 12% increase in usage since 2021, while cash and check transactions for P2P payments continue to decrease.

B2B Payments Go Digital

The shift towards digital payments is not limited to consumer transactions; it is also transforming the B2B landscape. Businesses are exploring digital alternatives for B2B transactions, driven by the potential for cost efficiencies and the need to align with evolving consumer preferences. While checks still hold some importance in B2B payments, the trend towards digitization is undeniable.

To navigate this changing landscape, businesses are turning to integrated payment solutions that streamline operations and enhance efficiency. Platforms like NMI offer comprehensive, all-in-one solutions that enable businesses to accept a wide range of digital payment options, including popular digital wallets. By partnering with such providers, businesses can simplify their payment processes and deliver a seamless experience to their customers.

As the dominance of digital payments continues to grow, it is essential for businesses to embrace these trends and adapt their strategies accordingly. By investing in robust payment infrastructure, leveraging data analytics, and prioritizing security, organizations can position themselves for success in the digital age. The future of payments is undoubtedly digital, and those who embrace this shift will be well-equipped to thrive in the years to come.

Navigating Regulatory Changes in Third-Party Partnerships

The regulatory landscape is undergoing significant changes, impacting how financial institutions collaborate with third-party partners. Nonbank financial companies (NBFCs) are facing enhanced regulatory oversight in the payments sector, compelling them to refine their risk management strategies and compliance practices. This increased scrutiny reflects a regulatory focus on safeguarding consumer interests and ensuring financial system integrity, prompting NBFCs to bolster their internal controls and governance frameworks.

Banks are becoming more selective in their partnerships with third-party providers, driven by the need to comply with stringent supervisory requirements. This cautious approach arises from the imperative to mitigate risks associated with non-compliance. As regulatory enforcement actions become more frequent, third-party entities that depend on banking partners must adapt to this evolving environment, aligning their operations with the heightened standards demanded by regulators.

Open Banking Drives Competition

The proposed open banking rule by the Consumer Financial Protection Bureau (CFPB) in 2023 is set to transform the competitive landscape by enhancing consumer access to financial data. This initiative empowers consumers with greater control over their financial interactions, fostering innovation and competition among financial institutions and third-party providers. For these entities, the challenge lies in navigating the complexities of data sharing while ensuring compliance with regulatory requirements.

Preparing for Compliance Costs and Cultural Shifts

As the regulatory environment evolves, entities with substantial scale and diverse offerings are better equipped to absorb the associated compliance costs and cultural adjustments. These organizations have the resources to implement necessary changes, maintaining compliance while continuing to deliver value to their clients. Conversely, smaller entities or those with limited offerings may face challenges in keeping up, potentially leading to market exits or industry consolidation.

In this shifting landscape, agility and adaptability are crucial. Organizations must proactively evaluate their compliance readiness, invest in necessary infrastructure, and foster a culture of continuous improvement. By doing so, they not only mitigate risks but also position themselves to seize emerging opportunities within the payments ecosystem, ensuring long-term growth and resilience.

The Rise of Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services have become a pivotal force in the consumer finance sector, offering a fresh approach to payment flexibility that resonates with current economic conditions. As consumers seek to mitigate financial pressures, BNPL firms are diversifying their reach into various sectors, especially those involving essential expenditures such as utilities and food. This strategy is about more than just delaying payments; it’s about empowering consumers to undertake larger purchases without immediate financial strain, supported by elevated spending thresholds that now extend up to $20,000.

Regulatory landscapes are being redefined in response to the growth of the BNPL sector. The Consumer Financial Protection Bureau (CFPB) has introduced new mandates for 2024 that enhance consumer protections, prompting BNPL providers to refine their operational models. These regulations not only fortify consumer trust but also introduce new operational expenditures for providers. The dual impact of these changes lies in securing consumer interests and establishing BNPL as a credible option within the financial ecosystem.

Banks’ Strategic Advantage in BNPL

The evolving regulatory environment offers a distinct advantage to banks with established regulatory compliance practices. Their existing structures and proficiency in navigating regulatory complexities equip them to seamlessly integrate BNPL services. By leveraging their compliance infrastructure, banks can incorporate BNPL offerings, thus meeting increasing consumer demand for adaptable payment solutions. As they broaden their service portfolios, banks can appeal to a wider customer demographic, thereby bolstering their competitive stance in the market.

Opportunities for Financial Institutions

The burgeoning BNPL trend presents a significant opportunity for financial institutions to engage with an expanding market eager for accessible low-interest financing options. The expansive consumer base is fueling BNPL’s growth, as individuals seek financial products that align with their spending preferences. Financial institutions that integrate BNPL options can capture this demand, particularly in areas where traditional credit avenues may not suffice. By doing so, they not only enhance their product offerings but also fortify their competitive positioning in an ever-evolving financial landscape.

The Power of Integrated Payment Options

The evolution of payment systems is seeing a robust shift towards integrated solutions, transforming how small and midsize businesses (SMBs) manage their operations. Integrated Software Vendors (ISVs) play a pivotal role in this shift, providing SMBs with comprehensive platforms that unify various operational facets. These solutions enable businesses to simplify their payment processes, thus improving operational efficiency by minimizing the need for multiple, disparate systems.

Innovation Based on Market Conditions

Recent developments in the regulatory landscape, particularly within the European Union, are catalyzing innovation in digital payment technologies. A key ruling permits third-party developers to access Apple’s NFC technology for digital wallet applications, effectively removing prior constraints tied to Apple Pay. This regulatory change is set to enhance competition among digital wallet providers, allowing businesses to develop diverse solutions that meet the sophisticated demands of modern consumers.

Social Media Drives Integrated Shopping

The intersection of social media and e-commerce is creating new opportunities for seamless consumer experiences. Platforms such as Meta are leading this trend by mandating the use of integrated checkout systems like Checkout on Facebook and Instagram. This approach allows consumers to complete transactions within the social media environment, eliminating the need to switch platforms. Such integration not only streamlines the purchasing process but also offers merchants critical insights into consumer behavior, enabling more strategic business decisions.

By embracing integrated payment options, businesses align themselves with consumer expectations, enhancing the overall shopping experience. With a significant percentage of consumers indicating that their choice of retailer is influenced by the available payment methods, integrating digital wallets becomes a strategic imperative for businesses aiming to succeed in a digital-first economy.

Leveraging AI and Machine Learning for Fraud Prevention

The integration of artificial intelligence (AI) and machine learning (ML) in fraud prevention is reshaping how financial institutions safeguard transactions. These technologies are pivotal in identifying and mitigating fraud, offering new levels of precision and agility in response to sophisticated cyber threats. By harnessing AI-driven models, institutions can swiftly recognize fraudulent patterns, maintaining robust defenses against evolving criminal tactics.

Beyond rapid detection, AI and ML provide deep insights into fraudulent behaviors, enabling financial entities to develop adaptive strategies. A significant portion of financial institutions are now turning to Generative AI to elevate their fraud management processes, focusing on crafting nuanced algorithms that can anticipate and counteract anomalies in real-time. This forward-thinking strategy ensures the integrity of digital transactions, bolstering consumer trust.

The Importance of Digital Identity in AI-Driven Fraud Detection

Accurate digital identity verification stands at the core of effective AI-driven fraud prevention. Ensuring the reliability of identity data allows AI systems to accurately distinguish between legitimate and suspect activities. This precision minimizes false alarms and strengthens security protocols, providing a robust framework for safeguarding financial transactions.

Personalized Insights Aid Behavioral Analysis

To augment fraud prevention efforts, financial institutions are enhancing the personalization of customer insights. AI enables the analysis of consumer spending habits and predictive behavior modeling, which aids in developing customized fraud detection systems. By offering customers detailed insights into their financial patterns, institutions empower them with a proactive role in security, aligning fraud prevention measures closely with consumer behavior and fortifying defenses against advanced fraud techniques.

Embedding Payments into Customer Experiences

In an era where digital transformation is at the forefront, businesses are reimagining how payments are integrated into their customer interactions. This shift involves adopting comprehensive strategies that not only streamline the payment process but also elevate the overall customer journey. By embedding payments directly into their platforms, businesses create an uninterrupted flow that enhances customer loyalty and drives engagement.

The advancement towards embedded payments signifies a pivotal change in how transactions are conducted, positioning it as a cornerstone of next-generation banking. This integration allows consumers to navigate the purchasing process with ease, eliminating traditional barriers and improving the checkout experience. As businesses facilitate this seamless interaction, they not only reduce cart abandonment but also foster a more personalized and engaging environment for their customers.

Competing for Value Based on Why and How Consumers Pay

The evolving payments landscape is increasingly defined by the contextual and behavioral insights derived from consumer transactions. Known as the “halo effect,” this shift prioritizes understanding the purpose and method behind consumer payments. Businesses that excel in this arena are those that can harness these insights to craft payment solutions that cater specifically to their market’s needs, thereby differentiating themselves in a crowded marketplace.

By utilizing sophisticated data analytics, companies can decode consumer behaviors and preferences, allowing them to refine their payment offerings. This approach not only enhances customer satisfaction but also strengthens the organization’s position in an ever-competitive industry. As the market continues to evolve, businesses must remain proactive, adapting their payment strategies to meet the dynamic expectations of their diverse clientele.

Aligning Payment Services with Consumer Preferences

In the rapidly evolving payments landscape, businesses must ensure their services align with consumer expectations to remain competitive. Payment leaders are now emphasizing bespoke product offerings, understanding that customization enhances user satisfaction and fosters a strong connection with their audience. By harnessing sophisticated data analysis tools, organizations can extract valuable insights from consumer interactions, tailoring payment solutions that resonate with the distinct preferences of their customer base.

Strengthening capabilities in scalability and protection remains a cornerstone for payment providers. As digital transaction volumes surge, businesses must ensure their infrastructures are equipped to handle this growth while safeguarding user data. Implementing advanced security protocols not only secures customer information but also establishes a reputation for reliability, which is crucial for maintaining consumer confidence. By reinforcing these core competencies, companies can expand their services, ensuring they cater to the diverse needs of today’s consumers.

Preparing for Opportunities Amid Shifting Market Dynamics

The payments industry is continuously influenced by a confluence of regulatory, economic, and technological shifts. These dynamics shape both consumer and merchant perspectives, requiring a proactive approach to service alignment. Companies must remain flexible, ready to adapt to evolving regulatory landscapes and technological innovations to sustain their market relevance.

By adopting a proactive strategy like IndustryAdvantage™, organizations can position themselves to capitalize on emerging opportunities while maintaining operational resilience. This approach focuses on aligning payment services with shifting consumer spending habits, enabling businesses to tap into new markets and strengthen their competitive position. Staying attuned to market trends and regulatory changes equips organizations to achieve sustainable growth, navigating the complexities of the digital payments environment with assurance.

As the payments landscape continues to evolve, embracing these transformative trends is essential for businesses to thrive in the digital age. By staying informed, adaptable, and customer-centric, organizations can navigate the complexities of the industry and unlock new opportunities for growth.

Related Frequently Asked Questions

What are the current payment technology trends?

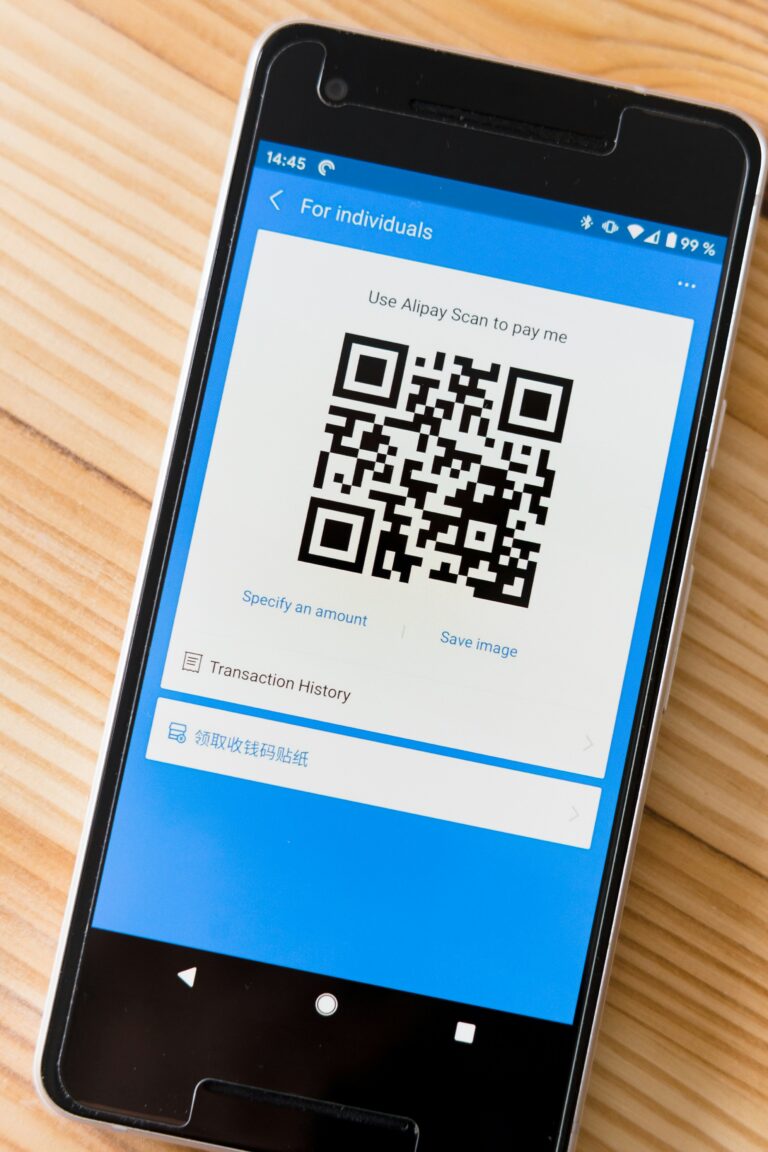

Key trends include embedded payments, real‑time payments, AI‑driven fraud detection, contactless mobile wallets, QR code payments, and biometric authentication.

Why are buy now, pay later and account‑to‑account transfers growing?

These methods offer flexibility and often lower costs, appealing to consumers and merchants looking to reduce friction and support multiple payment options.

How are digital wallet adoption and UX improvements impacting businesses?

Widespread digital wallet use and faster, more seamless checkout flows boost conversion rates and customer satisfaction, especially on mobile devices.

Devon Clark blends engineering expertise with fintech strategy, bringing 15+ years of experience at the cutting edge of embedded finance. As Director of Embedded Finance & Strategic Partnerships at a leading SaaS firm, Devon has scaled revenue channels, launched GTM partnerships, and simplified complex integrations. He’s passionate about democratizing access to financial tools and regularly contributes insights on emerging trends in B2B fintech infrastructure.