In today’s fast-paced business world, the ability to accept and process payments seamlessly is crucial for success. Merchant services play a vital role in enabling businesses to facilitate transactions and meet the evolving needs of their customers.

These services encompass a wide range of financial solutions designed to streamline payment processes and enhance the overall customer experience. By leveraging cutting-edge technology and secure payment channels, merchant services empower businesses to grow and thrive in an increasingly digital marketplace.

What Are Merchant Services?

Merchant services is a broad category of financial services tailored specifically for businesses. It provides companies with the tools and infrastructure needed to accept and process payments from customers through secure, encrypted channels.

At its core, merchant services enable businesses to handle transactions involving credit cards, debit cards, and NFC/RFID-enabled devices. This comprehensive suite of solutions includes:

- Credit Card Processing: Facilitating the authorization, processing, and settlement of credit card transactions, ensuring smooth and secure payments.

- Debit Card Processing: Enabling businesses to accept and process payments made using debit cards, providing customers with added convenience and flexibility.

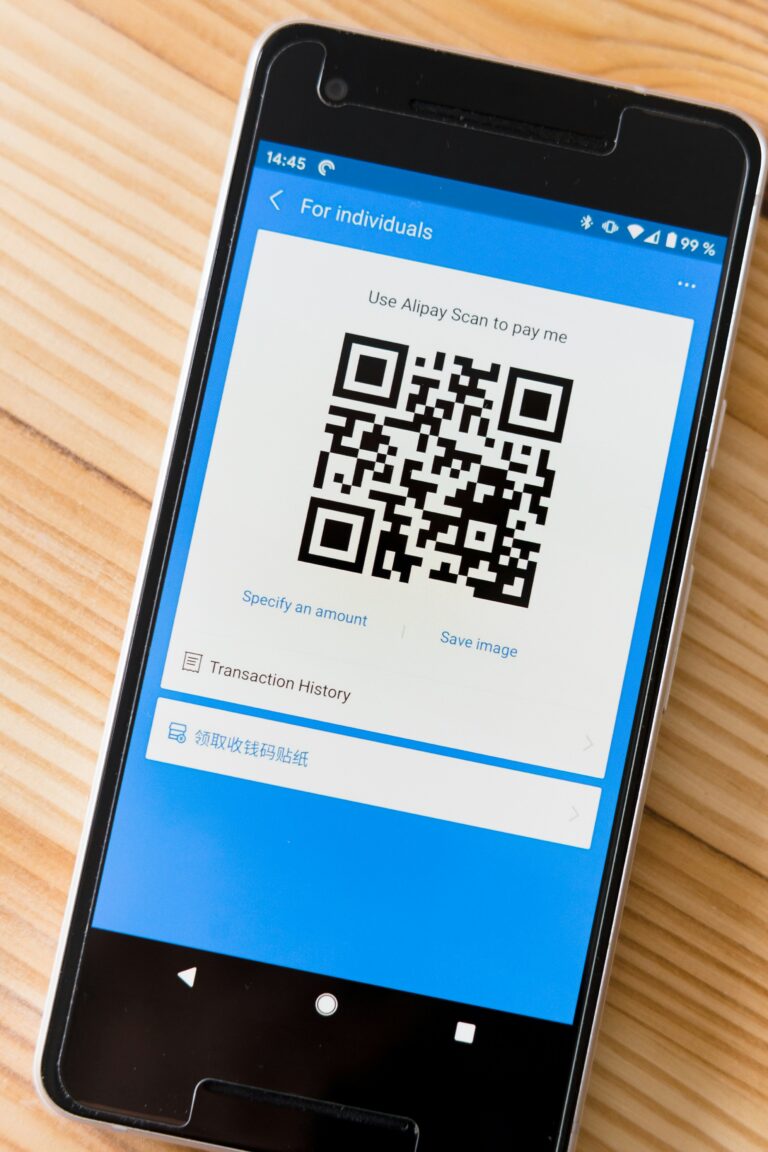

- NFC/RFID Payments: Accommodating the growing trend of contactless payments using near-field communication (NFC) or radio-frequency identification (RFID) technology, such as mobile wallets like Apple Pay or Google Pay.

Merchant services providers, such as NMI, offer a range of additional features and benefits to support businesses in managing their payment operations effectively. These may include:

- Payment Gateway Solutions: Facilitating secure online transactions by serving as an intermediary between the merchant’s website and the payment processing network.

- Point-of-Sale (POS) Systems: Providing hardware and software solutions for in-store payments, enabling businesses to accept various payment methods and manage inventory, sales, and customer data.

- Mobile Payment Processing: Allowing businesses to accept payments on the go using mobile devices, expanding their reach and flexibility.

- Gift Card and Loyalty Programs: Offering tools to implement and manage gift card and loyalty programs, fostering customer engagement and retention.

By leveraging merchant services, businesses can streamline their payment processes, reduce administrative burdens, and enhance the overall customer experience. These services not only simplify transactions but also provide a layer of security and fraud protection, safeguarding sensitive customer data and mitigating risks associated with payment processing.

Types of Merchant Services

Understanding the various types of merchant services is crucial for businesses aiming to optimize their payment processes. Each service type offers distinct advantages, catering to different business models and customer preferences. From online transactions to in-store payments, merchant services provide the flexibility and efficiency needed to keep pace with consumer expectations.

Payment Gateway Solutions

Payment gateways act as the secure digital conduits for processing online payments, ensuring that transactions are swift and protected. These solutions facilitate the seamless exchange of information between the merchant’s website and the financial institutions involved, providing a reliable backbone for e-commerce operations. Implementing a robust payment gateway enhances the ability of businesses to capture sales from a global customer base.

Point-of-Sale (POS) Systems

POS systems are integral to efficient in-store transactions, offering businesses an all-in-one solution for handling payments, managing inventory, and processing sales. Modern systems incorporate advanced technology to support contactless payments and real-time inventory tracking, enabling businesses to deliver quick and accurate service to customers. These features make POS systems essential for retailers looking to streamline operations and improve customer satisfaction.

Mobile Payment Processing

The capability to accept payments anywhere and anytime is a game-changer for dynamic businesses. Mobile payment solutions equip businesses with portable tools to process transactions using smartphones or tablets, making it easier to serve customers outside traditional storefronts. This flexibility is particularly advantageous for mobile vendors and service providers, allowing them to meet customers where they are, enhancing convenience and expanding market reach.

Gift Card and Loyalty Programs

Gift card and loyalty programs serve as strategic tools for enhancing customer relationships and encouraging repeat business. By offering incentives and rewards, these programs cultivate a loyal customer base and drive increased visit frequency. Gift cards also present a convenient option for customers seeking versatile gifting solutions, benefiting businesses through expanded sales opportunities and improved brand loyalty.

Additional Offerings

Beyond core payment processing, merchant services providers often present supplementary solutions like check processing and cash advances. Check processing services streamline the handling of paper checks, reducing processing time and mitigating the risk of fraud. Meanwhile, cash advances offer businesses quick access to funds, supporting operational liquidity and helping to manage unexpected expenses. Exploring these additional offerings allows businesses to tailor their payment solutions to better align with their operational needs.

Benefits of Using Merchant Services

Merchant services significantly enhance a business’s operational capabilities by expanding the range of payment options available. Businesses can now accommodate diverse methods such as digital wallets, mobile payments, and electronic fund transfers, tapping into a wider customer base. This inclusivity not only boosts transaction volume but also aligns with customers’ growing preference for digital and contactless payment solutions, fostering a more engaging shopping experience.

Efficient transaction management is a hallmark of merchant services, ensuring that businesses can process payments with minimal delays. By optimizing backend processes, companies benefit from accelerated cash flow, which is crucial for maintaining liquidity and agility in dynamic markets. This swift access to funds enables businesses to allocate resources more effectively, supporting rapid adaptation to market changes and operational demands.

The emphasis on robust security measures within merchant services cannot be overstated. Implementing cutting-edge technologies such as biometric authentication and multi-factor verification, businesses can safeguard customer data against unauthorized access and fraud. This proactive stance not only builds consumer trust but also fortifies the business against potential legal and financial repercussions associated with data breaches.

Comprehensive data analytics and reporting tools provided by merchant services equip businesses with actionable insights into their financial performance and customer behavior. Through detailed metrics and trends analysis, companies can fine-tune their operations to enhance efficiency and strategic planning. These insights empower businesses to make informed decisions that drive growth and competitiveness in the marketplace.

Selecting the ideal merchant services provider is a crucial step in enhancing your business’s operational efficiency and customer engagement. Start by assessing the types of payment solutions that align with your specific business operations. Whether you’re managing an e-commerce platform, a brick-and-mortar store, or a hybrid model, it’s vital to choose a provider that supports the full spectrum of payment options your customers might prefer. This ensures you can meet diverse customer expectations and capture every potential sale.

Attention to detail in the financial agreements offered by providers is essential. Scrutinize the array of fees associated with their services, including any transaction fees, account maintenance fees, or initial setup costs. It’s also wise to examine the terms of the contract, ensuring there’s flexibility to accommodate your business’s growth or changes without incurring hefty penalties. Understanding these financial implications can safeguard your profitability and provide strategic flexibility.

Evaluating the provider’s reputation and support infrastructure is key. A provider with a solid track record offers assurance of their capability to manage your payment processing needs effectively. Look for providers renowned for their reliability and robust customer support, which are essential for addressing any issues that might arise swiftly and efficiently. This ensures that your payment systems remain operational without disruption, maintaining your business’s credibility.

The security landscape is another critical consideration. Ensure the provider implements advanced security measures and complies with relevant industry standards to protect sensitive data. This involves checking their adherence to protocols like PCI DSS and their use of encryption technologies. A strong commitment to security not only shields your business from potential data breaches but also enhances customer trust, contributing to sustained business growth.

Getting Started with Merchant Services

Embarking on the integration of merchant services begins with a thorough evaluation of your payment processing landscape. Identify your business’s unique requirements by examining customer transaction preferences and operational pathways. Consider whether your clientele primarily engages with your business online, in physical locations, or through a hybrid of channels. Additionally, project your transaction volume to determine the scalability needs of your payment solutions, ensuring they align with both current demands and future expansion goals.

Once you’ve established your foundational needs, the next step is to methodically explore and compare merchant services providers. This involves a detailed investigation into their offerings, focusing on cost structures, technological capabilities, and support services. Evaluate how well their solutions integrate with your existing systems and their capacity to facilitate seamless transactions. This assessment guarantees that the provider not only meets your immediate operational requirements but also positions your business for strategic long-term success.

After selecting a provider that aligns with your objectives, proceed with the application process by furnishing essential business documentation. This documentation typically includes financial records and compliance verification, which expedite the approval process. Post-approval, prioritize the installation and configuration of your payment processing systems. This could involve deploying point-of-sale systems, integrating payment gateways, or establishing mobile payment frameworks. Ensuring your team understands these systems is crucial, requiring comprehensive training to optimize usage and efficiency.

Effectively communicating your enhanced payment options to customers can significantly boost engagement and satisfaction. Utilize a mix of communication channels to inform your audience about the new payment methods available, highlighting the convenience and security they offer. Whether through digital marketing, in-store promotions, or direct outreach, emphasizing these enhancements can attract new customers and reinforce loyalty among existing ones. By strategically presenting these advancements, your business can fully leverage merchant services to drive growth and foster customer trust.

Maximizing the Value of Merchant Services

Leveraging merchant services to their fullest potential involves a proactive approach to managing financial operations. Regularly reviewing merchant services statements is a pivotal practice for identifying cost-saving opportunities. By scrutinizing transaction fees and operational charges, businesses can pinpoint inefficiencies and negotiate better terms with providers. This diligent review process ensures that financial resources are allocated effectively, enhancing overall profitability.

Integrating features like prepaid cards and customer rewards systems can greatly enhance a business’s market position. These tools not only drive recurring sales but also deepen customer engagement. By offering targeted promotions and exclusive deals through rewards systems, businesses can boost customer satisfaction and drive revenue. These enhancements, when seamlessly incorporated, lead to a more engaging customer experience and a stronger market presence.

Being at the forefront of payment innovations is crucial for maintaining a competitive edge. Keeping pace with advancements such as digital wallets and secure tokenization can optimize processes and elevate security protocols. By adopting these advanced payment solutions, businesses can better align with customer expectations and adapt to the evolving digital commerce landscape. This commitment to technological advancement enables businesses to seize new opportunities and maintain a leading position in the market.

Delivering outstanding customer service is fundamental to extracting maximum value from merchant services. Prioritizing efficient and effective resolution of payment-related queries strengthens customer trust and loyalty. Training team members to adeptly manage these interactions ensures a high level of service and reinforces the business’s reputation as a customer-focused entity. This dedication to service excellence fosters long-term relationships and supports ongoing business success.

Merchant Services and the Future of Payments

The payment landscape is undergoing a transformation, with digital and innovative payment methods taking center stage. As consumers increasingly rely on their smartphones and other devices for transactions, businesses that adopt these technologies can cater to the demands of a digitally connected clientele. This evolution not only enhances transaction efficiency but also meets the growing need for seamless and quick payment experiences in an increasingly digital world.

Cutting-edge technologies such as tokenization and real-time processing are poised to revolutionize the security and transparency of payment operations. Tokenization replaces sensitive card details with unique identifiers, providing a layer of security that mitigates fraud risks. Real-time processing enables instantaneous transaction clearing, enhancing the speed and reliability of payment services and offering businesses a competitive edge through improved cash flow management.

Merchant services are integral to creating a unified commerce experience, harmonizing interactions across various consumer touchpoints. By leveraging integrated systems that span both digital and physical environments, businesses can deliver a consistent and engaging customer journey. This strategic alignment not only boosts customer satisfaction but also strengthens brand loyalty by accommodating the diverse preferences of today’s consumers.

Adapting to dynamic consumer behaviors necessitates a proactive stance on emerging payment technologies. As expectations for transparency, speed, and personalization continue to escalate, businesses must embrace these innovations to remain relevant. This involves continuously refining payment strategies to incorporate the latest advancements, ensuring alignment with market trends and customer desires.

Related Frequently Asked Questions

What are merchant services?

Merchant services are financial tools and solutions that enable businesses to securely accept and process electronic payments such as credit cards, debit cards, mobile wallets, POS systems, gateways, and loyalty programs. They facilitate authorization, settlement, and reporting functions.

How do merchant services process transactions?

When a customer pays, the transaction is sent via a payment gateway to an acquiring bank, which communicates with the issuer and card network. Once authorized, the merchant account is credited and settlement typically occurs within 24–48 hours.

What additional services can merchant service providers offer?

Beyond payment processing, they may support services like gift and loyalty programs, merchant cash advances, fraud prevention tools, payment orchestration, and integration with accounting and reporting platforms.

Chris Jenkins is a veteran compliance executive with over 20 years of experience in fraud prevention, regulatory frameworks, and enterprise risk management. Currently serving as Head of Risk & Compliance at a leading payments processor, Chris helps build systems that prevent and respond to real-time threats while maintaining compliance with international standards like PCI-DSS and PSD2. His career spans senior roles at global card networks and advisory positions for startups, where he’s known for marrying innovation with robust security protocols.